Our History

The journey of the Irreplaceable Corner™ Company started on a post baccalaureate trip to Florence Italy by one of our co-founders, Kerr Taylor. There, he discovered the beauty and benefit of time-tested plazas full of shops, people, offices, restaurants, and residences. These plazas were at very heart of thriving communities, and the concept for The Irreplaceable Corners was born. Kerr came back to Houston, Texas, and in 1985 began raising capital and investing in properties. In 1993, he formed AmREIT, a real estate investment trust (REIT).

Left to right: Chad Braun, Kerr Taylor, Tenel Tayar

In 1999 Chad Braun, one of our co-founders, joined AmREIT as its Chief Financial Officer and Chief Operating Officer. Tenel Tayar, our third co-founder, joined AmREIT as its Chief Investment Officer in 2003. Together they grew AmREIT from $50 million in assets to approximately $750 million in assets in 2012, when they took AmREIT public on the New York Stock Exchange (NYSE:AMRE). During this time they also developed strong joint venture relationships with firms such as AEW Capital Management, JP Morgan Asset Management, and Goldman Sachs.

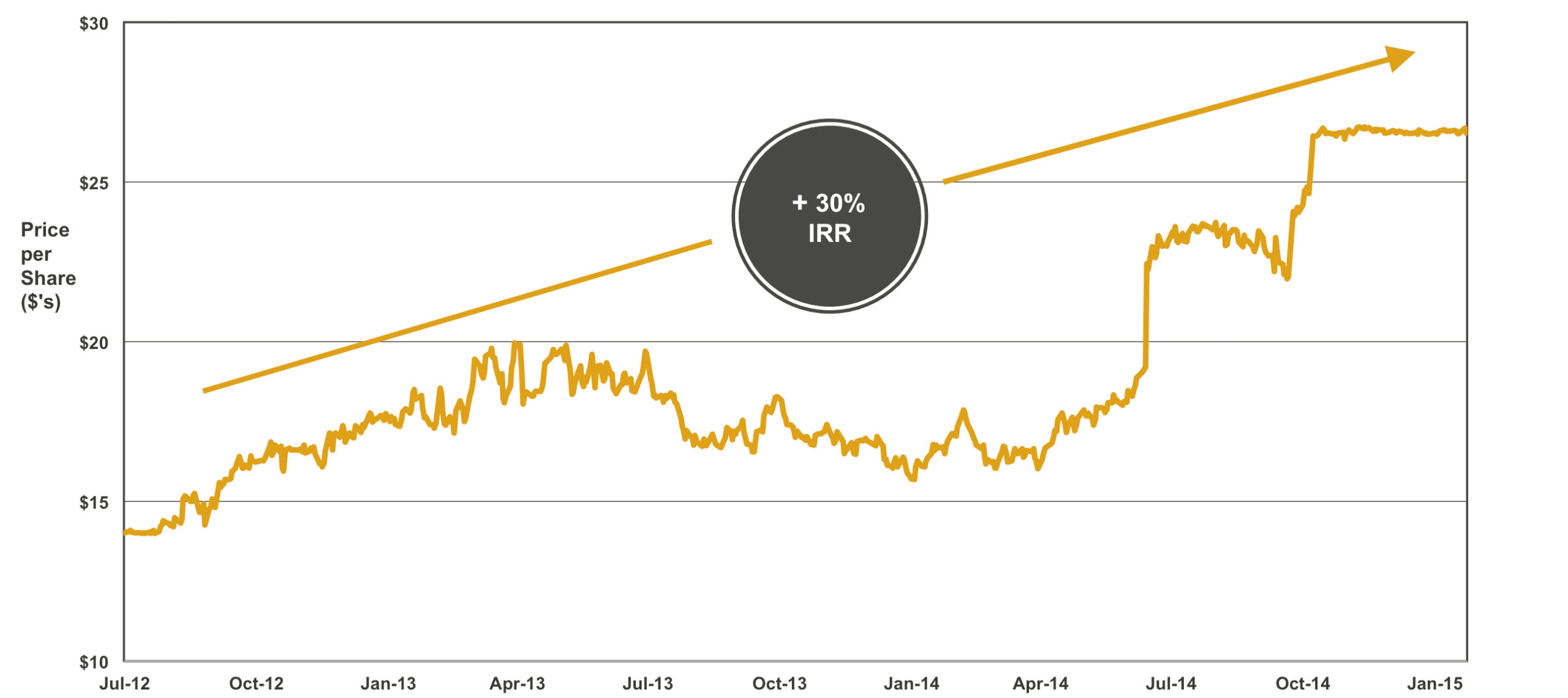

By 2014, AmREIT had grown to approximately $1.5 Billion in assets and was considered a small-cap envy of the shopping center REIT universe with the highest quality publicly-traded shopping center portfolio in the country. With multiple opportunities to sell the company, in February 2015 AmREIT decided to sell to a private REIT backed by JP Morgan, Blackstone, and the State of New York, harvesting value for shareholders and delivering returns in excess of 30% per annum to its public shareholders.

After the successful sale of AmREIT and value-realization for shareholders, Kerr opened his family office, Rowland Taylor, while Chad and T stayed to transition AmREIT, its employees, properties, and relationships until October 2016 when they resigned. In 2017 Kerr, Chad, and T rejoined and launched Fifth Corner based on their timeless strategies and culture, closing on the company’s initial round of capital and first two properties in February 2018. Fifth Corner now owns, or controls through joint venture, twelve Irreplaceable Corner properties.

Who We Are

For over three decades we have been focused on a “difference that matters”—for our investors, tenants, employees, and community. This “difference that matters” is grounded in two sets of principles. The first set of principles is focused on who we are as defined by our 5C Culture:

The 5C Framework for Leadership, Culture, and Life

At Fifth Corner, we are committed to creating vibrant places that serve local communities – places that are more memorable than they were prior to our involvement. Our properties are alive with customers returning again and again to their favorite grocery stores, restaurants, coffee shops, and boutiques. Shoppers tell us they frequent our properties more often than they do those of our competitors’—and that our places are more convenient, sustainable, or that they simply “feel” better.

No wonder we call them Irreplaceable Corners!

What We Do

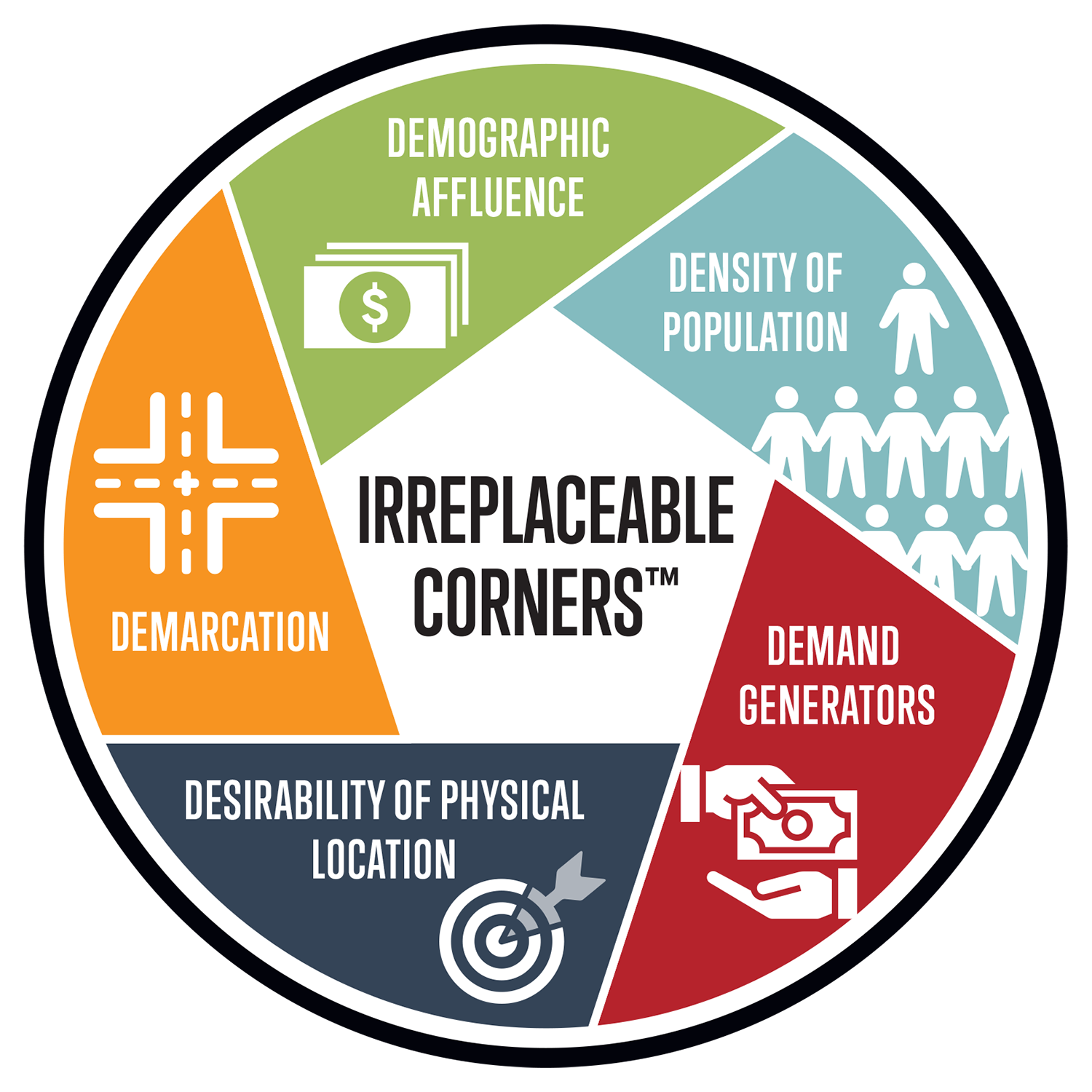

Our proven investment strategy has been honed through multiple economic and real estate cycles. Our second set of principles focuses on what we do, and reflects a disciplined approach to investing that is based on our 5D investment framework.

5-D Investment Framework

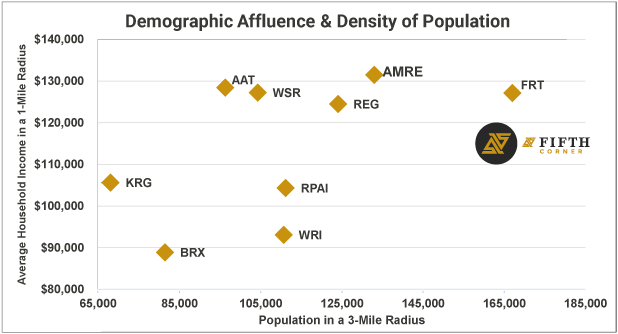

We choose to concentrate our efforts on building a portfolio located within the most affluent and dense submarkets of major metropolitan cities. We seek vibrant, community-facing locations that serve customers coming from a variety of nearby sources including office complexes, universities, medical systems, tourism, and residential households.

This disciplined approach has resulted in building two of the highest quality portfolios in the country – first with the AmREIT portfolio and now with the Fifth Corner portfolio!

A Disciplined Approach

Source: Esri 2020 and company websites

Generating:

- Higher than average percentage of value attributable to the land;

- Greater demand for space, resulting in superior occupancy and stability of cash flow; and

- Opportunity for densification and value creation through highest and best use.

“The consistency of short-term goals over a long period of time is what delivers sustainable success!”

– TD Jakes

Through the ownership, leasing, management, and redevelopment of our properties, Fifth Corner serves our communities with places to shop, dine, gather, live, work and play. Community is the fabric that keeps us connected, which makes community-facing Irreplaceable Corners a necessary, highly sought, and critical component of the urban ecosystem.

Meet Our Team

Great people are at the heart of what we do. Our experienced team of men and women are dedicated to serving the needs of our investors, tenants, and community.